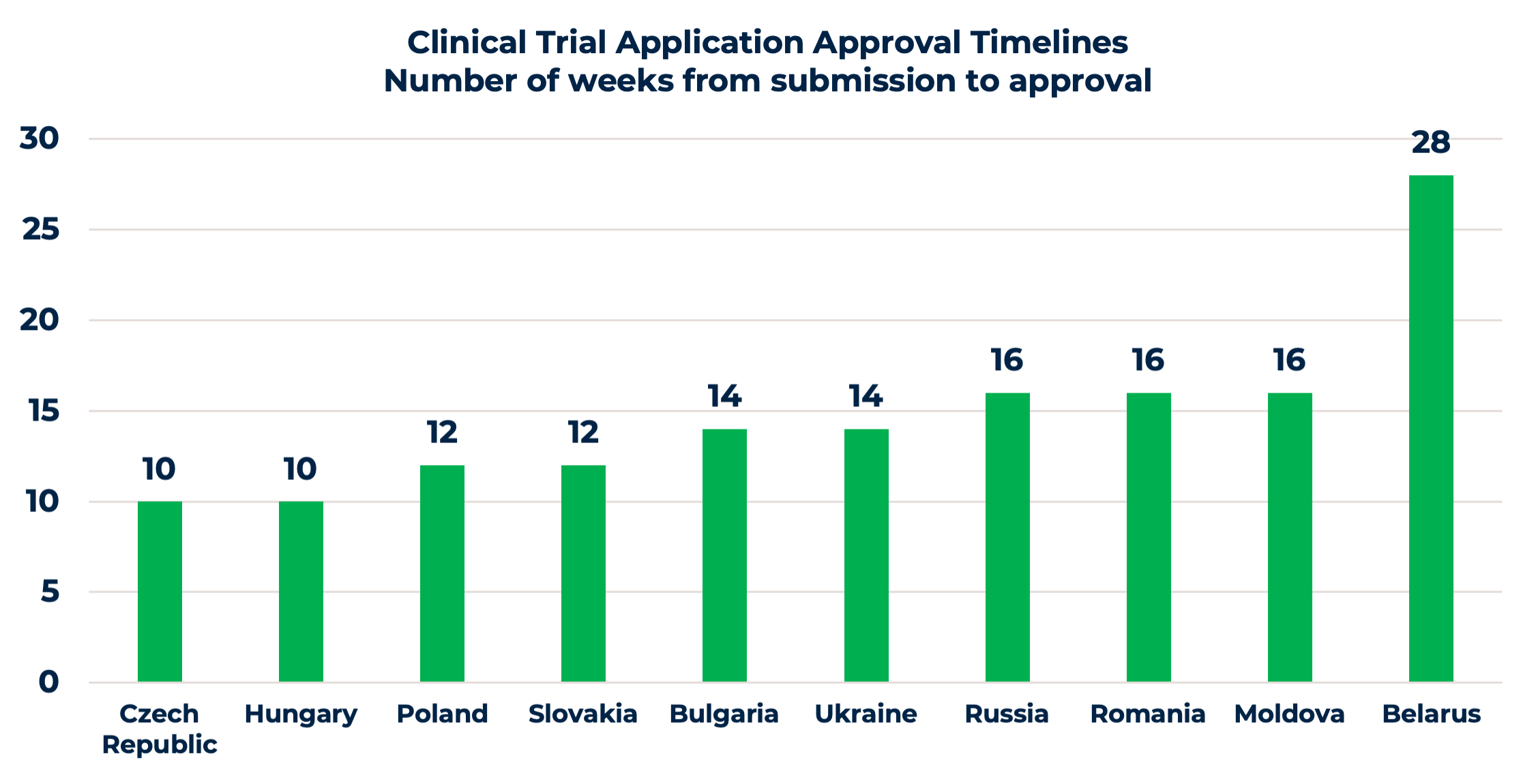

6. Clear regulatory environment and favorable study start-up timelines

Clinical trial approval is a crucial milestone to be met. While discussing the regulatory environment in Eastern Europe, we need to consider differences between EU and non-EU markets. Overall Eastern Europe offers a favorable regulatory environtment and study start-up timelines.

It is straightforward with EU submissions. Competent Authorities (CA) and Ethics Committees (EC) have similar regulatory requirements for clinical trial applications (CTA), with a few differences, such as national forms or site contracts. Approval timelines are quite favorable, varying from 10 to 16 weeks, as shown in the chart. Moreover, the upcoming changes and centralized CTA submissions through the EU Clinical Trial Information System (CTIS) will ease the process. Once the CTIS is in place, it will serve as a single-entry point for EU clinical trial applications and enable sponsors to obtain clinical trial approval in all European Economic Area (EEA) countries with one application.

Non-EU countries, i.e., Russia, Ukraine, Belarus, and Moldova, have several additional requirements, including translation and notarization of documents, IMP import requirements, etc. For a successful approval process, it’s highly recommended to use a clinical research organization with a local presence or to have experienced in-country staff, familiar with the local peculiarities and working practices of national CAs and ECs. Even though approval timelines are a bit longer compared to the EU, sponsors compensate this additional time spent later with savings thanks to faster patient recruitment.