Choosing the right set of countries, sites and investigators for a clinical trial are critical success factors in any clinical development program. They can guarantee speedy patient recruitment and timely delivery of study results. It also ensures that you conduct your clinical trial within budget and avoid delays that increase the overall study costs. In this article, we describe 7 reasons why to include Eastern Europe in your Clinical Trials Strategy for Pharmaceutical, Biotechnology and Medical Device products.

There are various reasons driving Sponsor’s decision to choose one or another country/site for their study. We can divide those reasons for the decision-making into two main categories – hard and soft criteria.

- Hard criteria can be described as feasibility results, incidence of condition/disease, country/site track record of recruitment in particular indication, investigator experience, country healthcare system peculiarities (e.g., reimbursed medicines, access to certain therapies), costs of clinical trial conduct in the country, etc.

- Soft criteria can be a relationship with an investigator, attitude/beliefs of key decision-makers, lack of previous experience in certain geographies or negative perception on particular countries, etc.

While planning clinical studies and choosing the best set of countries to conduct their trials, most companies commonly consider Eastern Europe because of the following:

- Eastern Europe represents largest patient population in Europe

- Excellent patient recruitment rates

- Proven Clinical Quality Standards

- Lower density of clinical trials in CEE

- Highly experienced and motivated investigators

- Clear regulatory environment and favorable study start-up timelines

- Competitive per patient costs

1. Eastern Europe represents largest patient population in Europe

According to the data of worldometers.info, Eastern Europe, which includes Russia, Ukraine, Poland, Romania, Czech Republic, Hungary, Belarus, Bulgaria, Slovakia, and Moldova, is the largest subregion in the continent, with a total population of around 293 million citizens (1). Simultaneously, all together, these markets represent the largest patient population in Europe. On its own, this is already a significant driver for companies to consider Eastern Europe in their clinical trial strategy.

In addition, non-EU countries like Russia, Ukraine, Belarus, and Moldova have a significant number of patients who are treatment naïve in terms of some newest therapies. This is thanks to the set-up of the healthcare system in these countries and differences in reimbursement of medicines compared to the EU, resulting in lower access to innovative therapies for patients. This is extremely important in clinical trials that require a cohort of treatment naïve patients according to their study design.

2. Excellent patient recruitment rates

Every clinical trial sponsor aims for speedy and timely recruitment to ensure their clinical development program continues without delays and within budget. However, according to BioPharma Dive, 85% of clinical trials fail to recruit enough patients, 80% are delayed due to recruitment issues and high dropout rates (2).

In case of delays, sponsors can either extend recruitment timelines for enrolling sites or initiate additional countries and sites. This is where Eastern Europe frequently plays its role, becoming the primary source of rescue sites. Therefore, considering adding these countries from the beginning of the study might help mitigate the risk of recruitment delays.

Outstanding patient recruitment in the region is directly related to other reasons to include Eastern Europe in your Clinical Trials Strategy mentioned:

- large pool of patients;

- lower density of clinical trials;

- lower number of competitive studies and higher motivation of investigators to recruit patients.

3. Proven Clinical Quality Standards

There is a perception that high-quality clinical trial data can only come from Northern- Western Europe or the US. But are there any real reasons to validate the doubts regarding the quality of clinical study conduct and data collection at Eastern European sites? Definitely – no. Can we bust this myth easily? Yes! There is concrete evidence to support the fact that there is no compromise to the quality of data in the region.

An analysis of 10 years of clinical site inspection data from the US Food and Drug Administration (FDA) showed no deficiencies were noted during 16.6%, 39.0%, and 21.5% of the inspections in Western Europe, Central Eastern Europe, and US, respectively (3). The percentages of inspections that didn’t require follow-up actions were 36.9% for Western Europe, 55.7% for Central Eastern Europe, and 44.3% for US sites. CEE was also the region with the lowest percentage of inspections that required official or voluntary action.

The conclusions of this publication were confident. Based on FDA inspection data, we can state that the high productivity of CEE sites goes hand in hand with regulatory compliance and data quality standards that equal those in Western regions.

4. Lower density of clinical trials in CEE

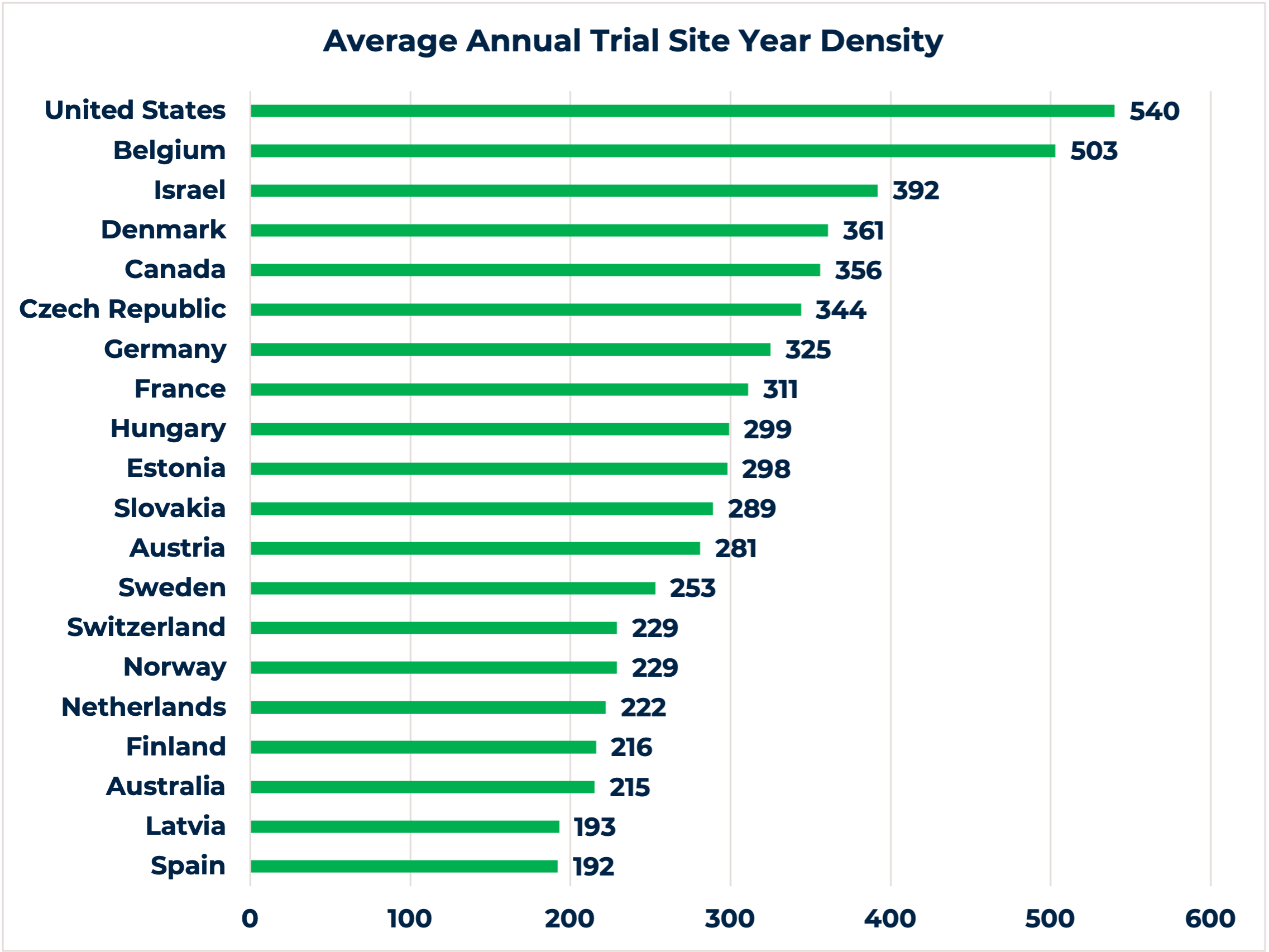

The chart demonstrates the top 20 countries globally with the highest average annual trial site year density during an 8-year period. With the exception to the Czech Republic, Hungary and Slovakia, 7 out of the 10 countries from Eastern Europe we mentioned in this article offer low annual trial density (i.e., Russia, Ukraine, Poland, Romania, Belarus, Bulgaria, and Moldova) (4).

While a lower density of clinical trials per country may not sound beneficial, it has a set of advantages for choosing such countries for clinical research conduct. Firstly, fewer studies at the clinical site also means less competitive trials, which is crucial information to evaluate before selecting a site. An ongoing competitive study might be a game-changer for timely patient recruitment, especially for orphan disease indications or clinical trials with stringent inclusion/exclusion criteria. Secondly, a lower number of studies per site can motivate investigators to recruit patients and dedicate more of their time to the trial, resulting in high-quality delivery.

5. Highly experienced and motivated investigators

One of the most important deliverables in clinical research is high-quality clinical data. It is obvious that it can be collected and delivered only by involving highly experienced and motivated investigators in your clinical trial strategy. Eastern European countries match the US and Western Europe regarding the expertise and professionalism of local investigators they offer. We need to emphasize that ICH-GCP standards are obligatory and regulated by local authorities. Clinical site inspection data can also be used as hard evidence to demonstrate the quality of clinical research delivery in the region, which directly depends on the performance of investigators and other involved site staff.

A lower density of clinical trials in the Eastern European countries also serves for the higher motivation of investigators. Investigators can dedicate much more attention to a particular study and are also highly motivated to provide their patients with innovative therapies, especially for those having no or very limited treatment options.

A lower number of clinical trials in Eastern Europe can lead to the assumption that investigators might be less experienced. However, centralized healthcare systems throughout Eastern Europe direct patients into specialized centers, usually large university hospitals. Concentration of clinical studies at these sites ensures that investigators there can offer specialized clinical research experience. Moreover, the high patient concentration at these centers/hospitals makes it easier to identify patients who meet study protocol inclusion criteria and to treat a large patient number at one site, i.e., demonstrate fast and reliable patient recruitment.

6. Clear regulatory environment and favorable study start-up timelines

Clinical trial approval is a crucial milestone to be met. While discussing the regulatory environment in Eastern Europe, we need to consider differences between EU and non-EU markets. Overall Eastern Europe offers a favorable regulatory environtment and study start-up timelines.

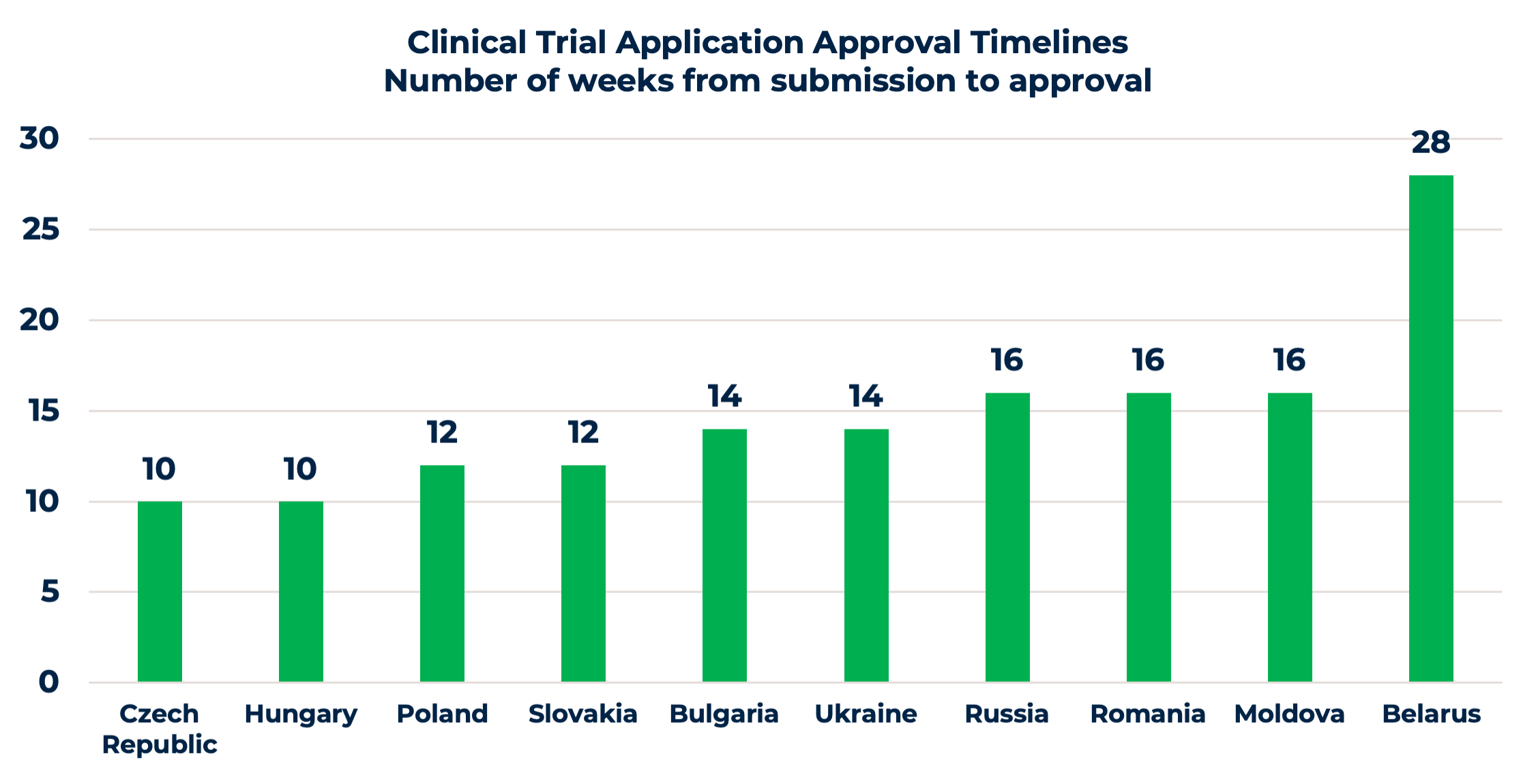

It is straightforward with EU submissions. Competent Authorities (CA) and Ethics Committees (EC) have similar regulatory requirements for clinical trial applications (CTA), with a few differences, such as national forms or site contracts. Approval timelines are quite favorable, varying from 10 to 16 weeks, as shown in the chart. Moreover, the upcoming changes and centralized CTA submissions through the EU Clinical Trial Information System (CTIS) will ease the process. Once the CTIS is in place, it will serve as a single-entry point for EU clinical trial applications and enable sponsors to obtain clinical trial approval in all European Economic Area (EEA) countries with one application.

Non-EU countries, i.e., Russia, Ukraine, Belarus, and Moldova, have several additional requirements, including translation and notarization of documents, IMP import requirements, etc. For a successful approval process, it’s highly recommended to use a clinical research organization with a local presence or to have experienced in-country staff, familiar with the local peculiarities and working practices of national CAs and ECs. Even though approval timelines are a bit longer compared to the EU, sponsors compensate this additional time spent later with savings thanks to faster patient recruitment.

7. Competitive per patient costs

The costs for clinical development and competitive per patient costs are key drivers for sponsors to look for solutions and ways to optimize the conduct of their clinical trials. Some choose to move forward with functional service provision models, outsourcing only activities that cannot be handled in-house. Some look for better suited geography, resulting in a lower overall study budget.

When it comes to the cost of a study, the expenses of labor and site fees are typically the highest in countries in Western (Germany, France, UK, Ireland, Benelux) and Northern Europe (Sweden, Denmark). Eastern European costs for labor are lower, i.e., resulting in lower clinical study budgets. The further east you conduct a clinical trial, the lower the labor costs will be and the costs of the study itself. Including Eastern Europe in your clinical trial strategy can lower costs by 20 to 40% compared to Northern-Western Europe or the Nordics, and even up to 50% compared to the US.

To sum up – Eastern Europe has a stably growing interest of clinical trial sponsors regarding study conduct in the region. Even though Eastern European countries might not be the one and only solution for all indications but can definitely and significantly benefit many clinical trial strategies. Therefore, sponsors should investigate the inclusion of clinical sites in this region in the study planning phase.

References:

- Worldometers.info (online link)

- Decentralized clinical trials: Are we ready to make the leap? (online link)

- Caldron PH, Gavrilova SI, Kropf S. Why (not) go east? Comparison of findings from FDA Investigational New Drug study site inspections performed in Central and Eastern Europe with results from the USA, Western Europe, and other parts of the world. Drug Des Devel Ther. 2012;6:53-60. doi: 10.2147/DDDT.S30109. (online link)

- Drain PK, Parker RA, Robine M, Holmes KK, Bassett IV. Global migration of clinical research during the era of trial registration PLoS One. 2018 Feb 28;13(2):e0192413. doi: 10.1371/journal.pone.0192413. eCollection 2018. (online link)

Other articles you might be interested in:

Clinical Trial Design For Early Phase Oncology Studies

Designing effective early-phase oncology trials is a complex and challenging task, requiring careful consideration of various factors, including patient selection, dosing, safety monitoring, and endpoint selection. In addition, developing targeted therapies has...

Oncology Study Design

Join us for a must-attend webinar on “Exploring Oncology Clinical Trial Design”, where expert speakers will share the latest insights.

Oncology trials in a shifting economical and geopolitical landscape

The pharmaceutical and biotech fields are spinning around, seeking to adapt to the current geopolitical situation and its impact on current and future oncology trials. Many trials have been shifted to other countries or regions while the complexity of managing risk...

Running Clinical Trials in Eastern Europe

It has become common practice for pharmaceutical companies to run clinical trials in Eastern Europe. However, it is also a common misconception that Eastern European countries only offer the lowest cost of operations as a benefit. This article shares insight into what...

All You Need To Know About Clinical Trials

So you want to improve your Clinical Trial expertise? Great! This field is snowballing and offers many opportunities for those with a suitable skill set. But before you dive in, it's essential to know what clinical research is all about. This article gives you a...

Selecting A CRO For An Early Phase Oncology Trial

As oncology drug developers, you likely know that selecting the proper Contract Research Organization (CRO) for your Phase 1 clinical trial is a crucial step in bringing your treatment to the market. This article provides insights for oncology drug developers when...

How Do Early Phase Oncology Trials Evolve?

In the last few years, a major breakthrough in cancer research has occurred: early phase oncology trials. This type of trial is designed to test whether a new drug has any adverse effects on people and also provides anecdotal evidence that it might be efficacious....

Running A Clinical Trial In Georgia

Moving Clinical Trials away from Ukraine and Russia Russia, Ukraine, and other CIS countries have been significant contributors to clinical trials in many therapeutic areas for several years. With access to experienced investigators, good quality, and large patient...

Running A Clinical Trial In Kazakstan

Moving Clinical Trials away from Ukraine and Russia For a long time, Russia, Ukraine and other countries in the Commonwealth of Independent States (CIS) have been the host of ample clinical trials in various therapeutic areas. And for a good reason: countries in the...

How to Avoid Delays in Your Early Phase Oncology Trial?

Many things can go array in your early phase oncology trials, from protocol development, taking care of a safety profile, getting the ethics committee / regulatory authority’s approval, managing vendors, and much more. They all cost precious time and increase the...